As any strong and sustainable building requires a strong foundation, to build your wealth you need to create a good foundation. The foundation should be made of reliable and sustainable materials. Similarly your wealth should be build on strong and sustainable financial elements.

Following list of financial elements are treated equivalent to CASH

- ETF

- SGB

- G-Sec

- T-Bills

- Sequre MF

Selecting pure strength would make the foundation rigid and loose its agility. That is why we must mix some Non-Cash elements which are relatively more riskier compared to CASH elements.

- Equity

- MF

A strong wealth foundation should be mix of both . Then only you will get secured and sustainable good return. An example of balanced split would be as follows.

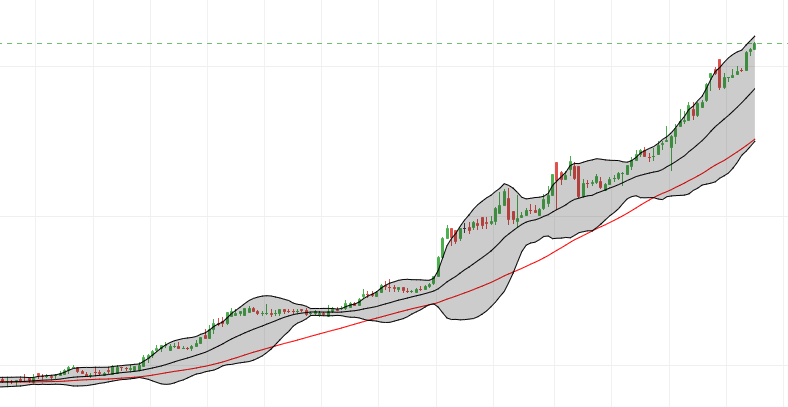

Here less fund is allocated for SGB(Sovereign Gold Bond). As of today 23rd Aug 2025 Gold has given a good run of 100%. From 2023 till date , after analysis of following gold bond chart it was decided to not put much in SGB. As it has appreciate much touching upper Bollinger band and 18% above Moving Average. A correction in gold price is expected.

So one must decide on split and percentage of split based on some basic analysis like above. But overal idea and structure remain same.

Once you split your capital in above financial elements. Foundation building is done. But having only a foundation is not enough. We have to use that foundation to build a wealth tower.

To achieve that we have to pledge our foundation to get margins. Margin is like the bricks which we use to build the tower over our foundation.

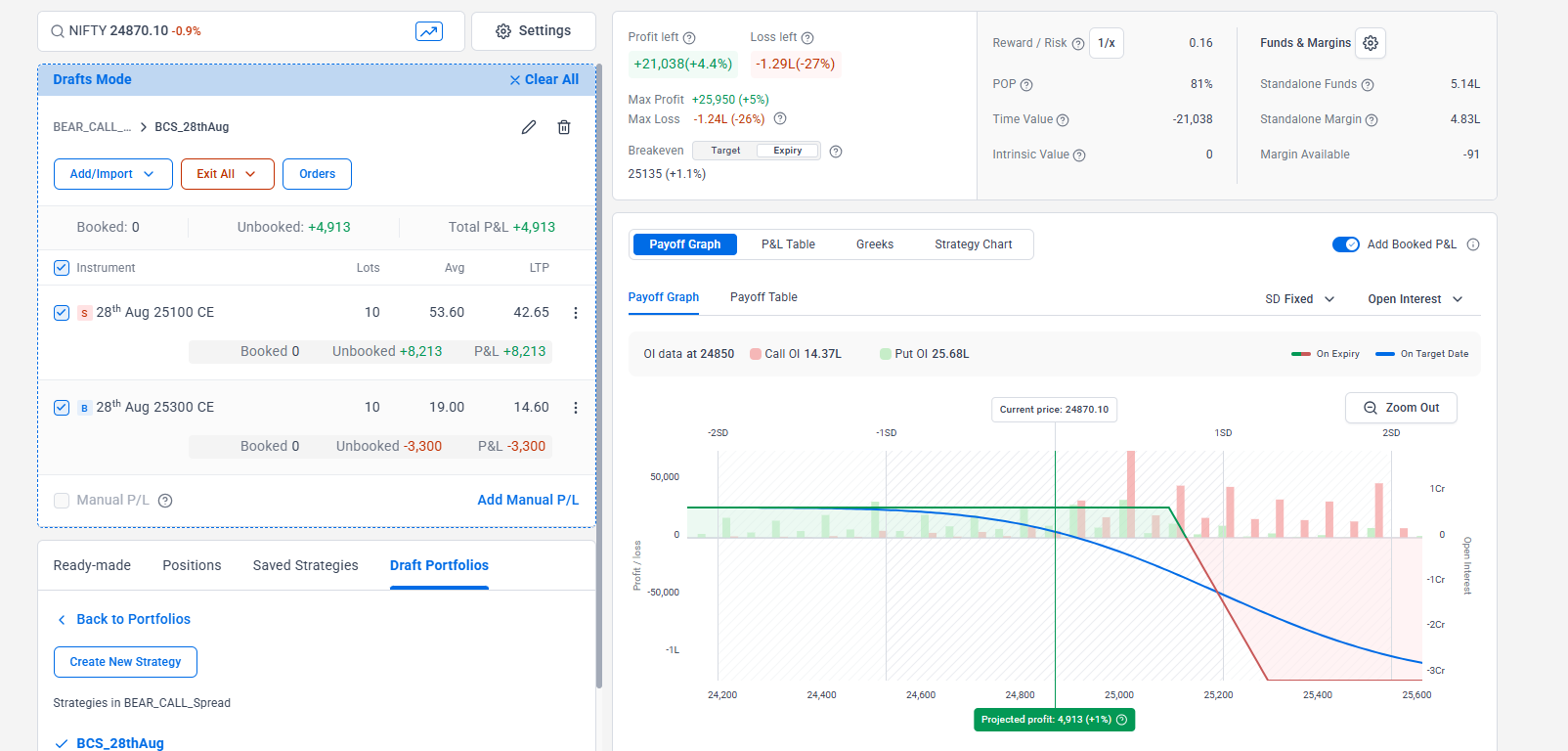

For above example a margin of 9L would be received post haircut. This margin could be used in F&O for secure strategies like Bull-Call-Spread/Bull-Put-Spread/Bear-Call-Spread/Bear-Put-Spread depending on market trend and your analysis of the market

Following is an example of Bear-Call-Spread.

It should give you 1% per expiry ( In NIFTY it is weekly )

By deploying above plan you would earn from both your base/foundation ( Cash and Non-Cash) and weekly spreads. Base should give you an average of 12-20 % return and your spreads will result in 40-60% per annum .

Leave a Reply